Economics

Since World War II the global economy is growing and most business strategies are based on this assumption, but the truth is, it’s changing now DRAMATICALLY.

Never before in recorded history have we seen such an enormous risk to the survival of the Global Monetary System. Monetary policy has created a nightmare. In a nutshell:

-

Long period of the lowest interest rate of the last 5000 years

-

Quantitative Easing policy has not only failed completely but has proven to be incorrect

-

Central banks have lost control of the economy and credit markets

-

Bond markets have been destroyed

-

And to make matters worse, NEGATIVE INTEREST. This has never been shown before in world history and disastrous for the economy.

Central banks have maneuvered themselves into a position where they cannot get out anymore. We must ensure that we profit from this instead of losing our business and wealth.

The key to Success to what is unfolding is understanding how the entire world economy is interconnected and functions on a grand scale.

Keep in mind that no country is an island, we are all connected. Do you remember the Great Financial Crisis of 2007-2009? It started in the US and spread to most other countries including India.

What is the Problem?

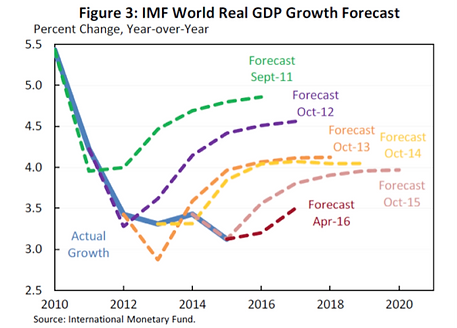

Well-known economist Kenneth Rogoff (professor of Economics Harvard and chess grandmaster) said that the economic knowledge of the established order such as Davos, IMF is always wrong. They have never been able to make reliable predictions.

As Larry Summers (prof. Economics Harvard and finance minister under Clinton) said in the Washington Post on December 6, 2015: “since WW2, no post-war recession has been predicted a year in advance by the Fed, The White House or the consensus forecast”.

There are three fundamental problems with current economic theories and models:

-

Economist do not understand what MONEY is and how it works. They have a limited and static view of money (M1-M4) while money is far more complex and dynamic.

-

Everything is connected to everything, GLOBALLY!

-

It is a dynamic system and not a static system as economists assume.

From this approach, it is therefore impossible to create a correct model. That’s why the models used by central banks, banks, IMF etcetera don’t work. The 2007-2009 Great Financial Crisis is proof of this because none of these institutions saw it coming. See the above graph of the IMF itself. They are structurally wrong!

Our Solution: It's ALL about the MONEY!

Our economic analysis differs from establishment like the IMF, Davos and central banks because we don’t start with all kinds of assumptions and try to prove these assumptions. We let the FACTS lead us and NOT ASSUMPTIONS.

Understanding what MONEY is and how it works is the basis of our analysis. Keep in mind, where money flows to grows, where money flows away from shrinks.

Using advanced Artificial Intelligence models, we analyze 2000 years of historical cyclical patterns and correlations. We also study global traders who know from real live experience how the global economy works. We are part of this international network. In other words, our research is based on FACTS and NOT ASSUMPTIONS.

We also analyze the international financial markets because they tell us where the economy is heading years in advance. You only have to listen carefully what the markets tells you. Most analyst don’t listen but try to tell the market their opinion.

Keep in mind, all our lives and businesses are rooted in the economy, understanding and anticipating the coming disruptions is the only way to protect your business and private assets.

We are now entering transformation phase which will last for approximately ten years in which the financial systems will need to be redesigned. This transition goes with together with hard times for those who do not prepare. The war in the Ukraine, Middle-East, the tension between United States vs China is all part of this transition.

Charles Darwin said: “It’s not the biggest, brightest or the best that will survive, but those who adapt the quickest”.